Unveiling the Three Insurance Appetite Guide, a groundbreaking framework designed to revolutionize risk management and strategic decision-making within the insurance industry. This comprehensive guide provides a structured approach to understanding and defining an insurer’s risk tolerance, enabling informed underwriting practices and optimized pricing strategies across diverse insurance sectors. From property to casualty to life insurance, this guide will empower insurers to thrive in today’s dynamic market landscape.

This guide delves into the core elements crucial for a robust insurance appetite, including a detailed breakdown of the factors influencing risk tolerance, a practical framework for risk assessment, and actionable strategies for implementing the guide into daily operations. The guide also features illustrative examples and a set of key performance indicators (KPIs) to measure the effectiveness of the strategy, providing insurers with a clear roadmap to achieve optimal results.

Introduction to Insurance Appetite

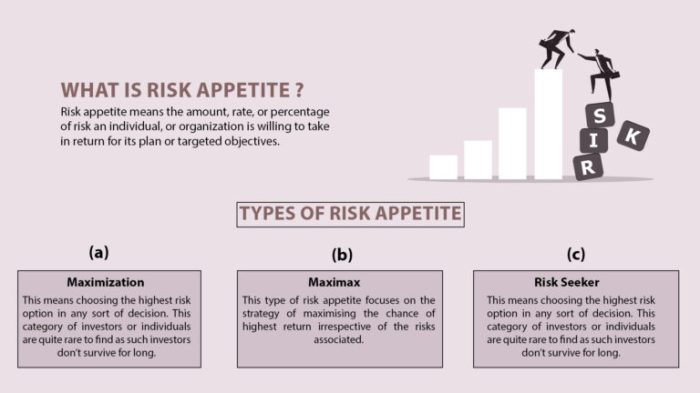

Insurance appetite refers to an insurer’s willingness and capacity to accept risks within specific parameters. It encompasses the types of risks an insurer is prepared to cover, the associated premiums, and the potential financial implications. Understanding insurance appetite is crucial for strategic decision-making, ensuring profitability, and maintaining financial stability.

Factors Influencing Insurance Appetite

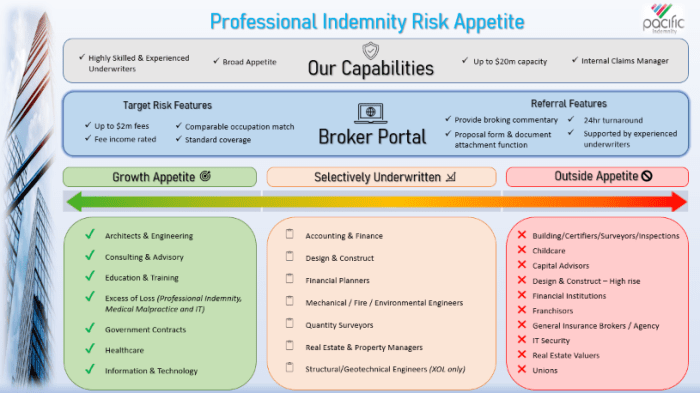

Several factors shape an insurer’s appetite for different types of risk. These include regulatory requirements, economic conditions, competitive pressures, historical claims data, and the insurer’s overall risk tolerance. Insurers with a higher risk tolerance may be more inclined to underwrite more complex or high-exposure risks, while those with a lower tolerance will focus on more predictable and lower-exposure risks.

Importance of Understanding Insurance Appetite

A well-defined insurance appetite provides a framework for strategic decision-making. It guides investment strategies, underwriting practices, and product development, ultimately leading to more profitable and sustainable business operations.

Insurance Appetite and Underwriting Practices

Insurance appetite directly influences underwriting practices. Underwriters use the appetite guide to evaluate risks, determine appropriate premiums, and decide which applications to accept or reject. This ensures that the insurer’s portfolio aligns with its defined risk tolerance and financial objectives.

Examples of Insurance Appetites Across Sectors

Different insurance sectors exhibit varying insurance appetites. Property insurers may have a higher appetite for risks related to natural disasters in regions with a lower historical frequency of such events, while casualty insurers might prioritize risks with demonstrably lower claim frequencies. Life insurers may focus on risks associated with longevity and mortality, with a strong focus on underwriting and actuarial models to assess and price accordingly.

Key Characteristics of a Strong Insurance Appetite

| Characteristic | Description | Impact on Business | Example |

|---|---|---|---|

| Clearly Defined | Appetite is explicitly documented and understood by all stakeholders. | Reduces ambiguity, improves decision-making. | A formal policy document outlining the insurer’s risk tolerance levels. |

| Data-Driven | Decisions are supported by robust data analysis and actuarial modeling. | Ensures accurate pricing and risk assessment. | Using historical claims data to predict future payouts. |

| Flexible | Appetite can adapt to changing market conditions and emerging risks. | Maintains competitiveness and responsiveness. | Adjusting risk tolerance for specific geographic regions or industries. |

| Transparent | All stakeholders understand the rationale behind the appetite framework. | Promotes trust and accountability. | Clear communication channels for clarifying appetite guidelines. |

Components of a Three-Part Insurance Appetite Guide: Three Insurance Appetite Guide

A comprehensive insurance appetite guide typically comprises three core elements: risk assessment, pricing strategy, and strategic alignment. These elements work in tandem to ensure the insurer’s portfolio remains aligned with its financial objectives.

Risk Assessment

A robust risk assessment framework is essential for identifying and evaluating potential risks. This involves identifying various risk factors, analyzing their likelihood and potential impact, and prioritizing them based on severity.

Pricing Strategy

Pricing strategies directly reflect the insurance appetite. Premiums must be appropriately calibrated to reflect the calculated risk, considering the insurer’s cost structure, and maintaining profitability.

Understanding your insurance appetite is crucial for financial planning. Three insurance appetite guides can help you assess your needs and find the right coverage. If you’ve experienced a personal injury, a personal injury lawyer sugar land texas, like the ones found at personal injury lawyer sugar land texas , can help you navigate the complexities of insurance claims and ensure you’re adequately compensated.

Ultimately, a thorough understanding of your insurance appetite remains vital for protecting your assets and well-being.

Strategic Alignment, Three insurance appetite guide

The guide ensures that the insurance appetite aligns with the overall business strategy. This ensures that the insurer’s decisions regarding risk acceptance are consistent with its long-term goals.

Three-Part Guide Structure

| Component | Sub-element 1 | Sub-element 2 | Sub-element 3 |

|---|---|---|---|

| Risk Assessment | Risk Identification | Risk Evaluation | Risk Prioritization |

| Pricing Strategy | Premium Calculation | Pricing Models | Reinsurance Strategies |

| Strategic Alignment | Business Objectives | Regulatory Compliance | Market Positioning |

Rationale for the Three-Part Guide

The three-part structure ensures a holistic approach to managing risk. It integrates risk assessment, pricing, and strategic alignment to foster a sustainable and profitable insurance business.

Impact on Pricing Strategies

Source: com.au

A well-defined insurance appetite guide directly impacts pricing strategies. By identifying acceptable risk levels, insurers can develop pricing models that reflect the calculated risk, thereby maintaining profitability.

Different Approaches to Creating a Guide

Source: medium.com

Various approaches exist for creating a three-part insurance appetite guide. Some insurers may focus on a quantitative approach, using statistical models to assess risk, while others may prioritize a qualitative approach, relying on expert judgment. A hybrid approach combining both methods is also possible.

Conclusive Thoughts

Source: myfinopedia.com

In conclusion, the Three Insurance Appetite Guide provides a powerful tool for insurers seeking to navigate the complexities of risk management and optimize their strategic positioning. By understanding and defining their appetite for risk, insurers can enhance underwriting practices, refine pricing models, and ultimately bolster their profitability and long-term sustainability. This guide offers a practical and adaptable framework that can be tailored to meet the unique needs of any insurance organization, equipping them with the knowledge and tools to thrive in an increasingly competitive market.

The examples and KPIs further provide tangible applications and metrics to track progress and make necessary adjustments along the way.