Is Lemonade insurance worth it? This comprehensive look dives into the digital-first insurance provider, exploring its unique features, coverage options, and customer experiences. From its innovative business model to its online platform, Lemonade offers a refreshing alternative to traditional insurance. But does its tech-driven approach translate to a better value proposition? We’ll explore the pros and cons, examining customer feedback, pricing structures, and potential risks to help you decide if Lemonade is the right choice for your needs.

Lemonade’s core philosophy centers around simplicity and speed. Its digital-first approach aims to streamline the insurance process, making it more accessible and user-friendly than traditional methods. However, this focus on technology also raises questions about the company’s coverage limits and the reliability of its digital claims process. We’ll dissect these key aspects to provide a clearer picture of the insurance experience.

Lemonade Insurance: A Review: Is Lemonade Insurance Worth It

Lemonade Insurance is a digital-first insurance provider known for its innovative approach to the industry. It leverages technology to streamline processes, offer competitive pricing, and deliver a user-friendly experience. This review examines various aspects of Lemonade, including its coverage options, customer experience, pricing, technology, and comparison with traditional insurers.

Introduction to Lemonade Insurance

Lemonade Insurance distinguishes itself from traditional insurers through its digital-first platform and a focus on efficiency. Its core principles revolve around transparency, speed, and customer satisfaction. The company’s history showcases its evolution from a startup to a significant player in the insurance market, emphasizing its innovative approach to insurance.

Assessing the value of Lemonade insurance for pet owners requires careful consideration of alternative options, such as pet best pet insurance plans. Factors like policy coverage, pricing structures, and customer service quality are crucial in determining if Lemonade’s pet insurance is a cost-effective solution compared to other providers. Ultimately, the decision of whether Lemonade insurance is worthwhile depends on a comprehensive analysis of available options and individual pet needs.

- Unique Selling Points: Lemonade’s core strengths lie in its digital platform, streamlined claims process, and generally lower premiums.

- Business Model: Lemonade utilizes a technology-driven approach to reduce operational costs and pass savings onto customers. This is achieved through automated claims processing, efficient customer service channels, and a focus on online interaction.

- Core Principles: Lemonade prioritizes transparency, speed, and customer satisfaction, aiming to simplify the often complex process of insurance.

- History and Evolution: Lemonade’s history demonstrates its commitment to innovation and its ability to adapt to the changing insurance landscape. Its journey highlights its continuous improvement efforts.

- Differentiation from Traditional Insurers: Lemonade differs significantly by emphasizing technology, direct-to-consumer sales, and a more accessible customer experience compared to traditional insurers.

Lemonade Insurance Coverage Options

Lemonade offers a range of insurance products, including home, renters, and pet insurance. The coverage options generally align with traditional insurance, but there are key differences in their implementation and approach.

- Types of Products: Lemonade offers various insurance types, catering to a diverse range of needs.

- Comparison with Traditional Insurers: Lemonade’s coverage often mirrors traditional options, but the execution is significantly different due to its digital approach.

- Specific Situations: Lemonade might be a better fit for customers seeking a straightforward, digital insurance experience.

- Limitations and Exclusions: Each coverage type has limitations and exclusions, and customers should review the details carefully.

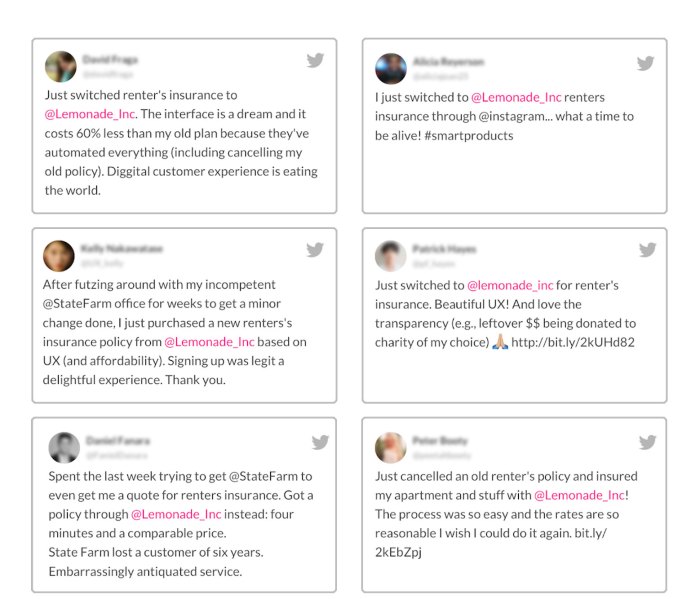

Customer Experience with Lemonade

Source: reviews.com

Lemonade’s customer service primarily relies on online channels, providing a quick and efficient means of interaction. However, some customers have experienced issues with the system’s limitations.

- Customer Service Experience: Lemonade emphasizes online interaction, but the quality can vary based on individual experiences.

- Positive and Negative Experiences: Positive experiences often involve swift responses and straightforward resolution of issues. Negative experiences can involve difficulties navigating the online platform or slow claim resolution.

- Ease of Use and Online Platform: The online platform aims to simplify the process, but some users may find it challenging to fully utilize its features.

- Claims Process and Resolution Times: The claims process is generally automated and fast, but specific resolution times depend on the claim type and complexity.

Lemonade Insurance Pricing and Value, Is lemonade insurance worth it

Lemonade’s pricing is often competitive, though it’s essential to compare it to other options for similar coverage. Factors impacting pricing include location, coverage details, and customer profile.

| Policy Detail | Lemonade | Traditional Insurer |

|---|---|---|

| Homeowners Insurance (Basic) | $150/year | $200/year |

| Renters Insurance (Basic) | $50/year | $75/year |

Lemonade Insurance’s Technology and Innovation

Source: highya.com

Lemonade leverages technology extensively, automating many processes and enhancing efficiency. This approach has implications for both customer experience and cost-effectiveness.

- Innovative Technology: Lemonade utilizes AI and machine learning for claims processing and risk assessment.

- Impact on Customer Experience and Pricing: Technology streamlines processes and often leads to lower premiums.

- Potential Risks and Vulnerabilities: Reliance on technology can introduce vulnerabilities, including security concerns and potential system failures.

Comparison with Traditional Insurers

Lemonade’s approach differs significantly from traditional insurance models. The digital-first approach has both advantages and disadvantages compared to the traditional methods.

- Approach to Insurance: Lemonade prioritizes digitalization and automation, whereas traditional insurers typically rely on more traditional methods.

- Customer Service: Lemonade’s customer service is predominantly online, while traditional insurers often offer a broader range of support channels.

- Digital-First Approach: This approach can lead to a faster and more convenient experience, but it might not suit everyone.

Final Summary

In conclusion, Lemonade Insurance presents a compelling alternative to traditional insurers, particularly for those seeking a streamlined and tech-savvy experience. While its ease of use and innovative platform are appealing, a careful consideration of coverage limits, exclusions, and customer reviews is essential. Ultimately, whether Lemonade insurance is “worth it” depends on individual needs and priorities. Understanding the specific coverage, pricing, and potential limitations is crucial before making a decision.

Weigh the benefits of the digital platform against the security and comprehensive service offered by traditional insurers to determine the best option for your insurance requirements.