John Hancock Trip Insurance offers comprehensive protection for your travel adventures. This insurance safeguards you against unexpected disruptions, ensuring a smooth and worry-free journey. From medical emergencies to lost luggage, and trip cancellations to delays, this comprehensive plan provides essential support for your peace of mind. It details various types of trip disruptions, comparing its features to a competitor’s product to give a clearer picture.

This guide delves into the specifics of coverage, outlining medical expense protection, baggage coverage, trip cancellation and interruption options, and trip delay procedures. It details the purchasing process, claim procedures, and customer feedback. Further, it compares John Hancock Trip Insurance with other providers and explains policy exclusions and terms.

John Hancock Trip Insurance: A Comprehensive Guide

Source: cloudfront.net

Navigating the complexities of travel can be daunting. From unexpected medical emergencies to lost luggage, securing comprehensive travel insurance is crucial for a smooth and worry-free journey. John Hancock Trip Insurance provides a robust safety net, offering coverage for various unforeseen circumstances. This guide delves into the intricacies of this insurance, covering key features, coverage details, purchasing procedures, and customer feedback.

Introduction to John Hancock Trip Insurance

Source: cloudinary.com

John Hancock Trip Insurance is a travel insurance product designed to safeguard travellers against a range of potential disruptions during their journeys. It offers a range of benefits, from medical expenses to trip cancellations, providing peace of mind for travellers.

- Definition: John Hancock Trip Insurance offers protection against unforeseen circumstances that might impact a trip, including medical emergencies, trip cancellations, and lost baggage.

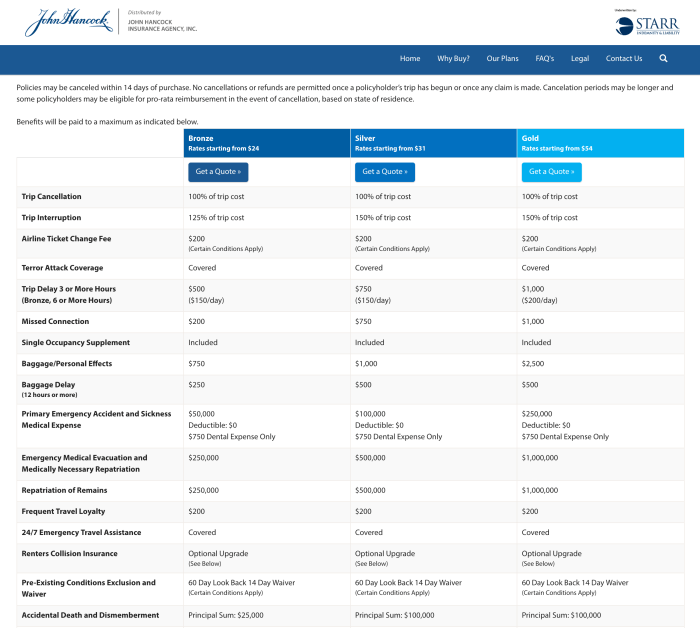

- Key Features and Benefits: Comprehensive coverage for medical expenses, trip cancellations, trip interruptions, lost baggage, and trip delays are among the core benefits. Policies often include options for enhanced coverage based on individual needs.

- Types of Trip Disruptions Covered: The insurance covers a wide array of disruptions, including medical emergencies, trip cancellations due to unforeseen events, trip interruptions, and delays. Specific coverage details vary depending on the chosen policy.

- Scenarios of Benefit: This insurance is beneficial for travellers in a variety of scenarios, including those facing unexpected medical emergencies, flight cancellations, natural disasters, or lost baggage. It’s particularly valuable for individuals travelling to destinations with limited medical facilities or those with pre-existing conditions.

- Comparison to Competitor:

Feature John Hancock Trip Insurance Competitor X Medical Expense Coverage Includes emergency evacuation, hospitalisation and more. Limited coverage for basic medical care. Trip Cancellation Coverage Covers cancellations due to unforeseen events. More limited circumstances, potentially excluding some events. Price Competitive pricing. May be more or less expensive, depending on the policy.

Coverage Details

Source: thebestandbrightest.com

Understanding the specific elements of coverage is vital for travellers. The policy details define the specifics of the protection offered.

- Medical Expenses Coverage: Covers a range of medical expenses, including emergency medical treatment, hospitalisation, and repatriation. Exclusions may apply for pre-existing conditions.

- Baggage and Personal Effects Coverage: Protects against loss or damage to baggage and personal belongings. Policies often have limits on the amount of coverage.

- Trip Cancellation and Interruption Coverage: Covers financial losses incurred due to unforeseen circumstances leading to cancellation or interruption of a trip. This typically includes events like natural disasters or medical emergencies.

- Trip Delay Coverage Options: Covers expenses related to delays in travel plans, such as accommodation, meals, and other reasonable expenses.

- Excluded Circumstances: Policies generally exclude coverage for pre-existing conditions, intentional acts, or conditions that could have been avoided through reasonable precautions.

- Coverage Limits:

Coverage Type Limit (Example) Medical Expenses £100,000 Baggage £1,000 Trip Cancellation Full trip cost (up to limit)

Purchasing and Claim Process, John hancock trip insurance

A smooth purchasing and claim process is essential for hassle-free travel insurance.

John Hancock trip insurance covers unexpected travel disruptions. Considering comprehensive protection, you might also want to explore whether Allstate offers homeowners insurance, as a separate but related concern. Does Allstate do homeowners insurance ? Ultimately, securing suitable travel insurance remains crucial for a smooth trip experience with John Hancock.

- Purchasing the Insurance: The process typically involves selecting a plan, providing personal details, and paying the premium.

- Filing a Claim: Contacting the insurer directly and providing required documentation is crucial. Claims processes vary depending on the insurer.

- Claim Documentation: Supporting documents, such as medical records, flight confirmations, and receipts, are needed to process a claim.

- Claim Submission Methods: Online portals, phone calls, or email are common claim submission methods. Each insurer has its preferred methods.

- Customer Service Contact Information: The contact information for customer service representatives can be found on the insurer’s website or policy documents.

- Common Claim Scenarios and Resolution Times:

Scenario Estimated Resolution Time Lost Luggage 7-14 days Trip Cancellation 5-10 days

Final Wrap-Up: John Hancock Trip Insurance

In conclusion, John Hancock Trip Insurance provides a robust safety net for travelers, covering a wide array of potential issues. By understanding the policy’s features, coverage details, purchasing process, and customer reviews, you can make an informed decision about whether it aligns with your travel needs. The comparison with competitor products, along with the clear explanation of policy exclusions, will empower you to weigh the benefits against other options available.