Reviews for Allstate homeowners insurance paint a multifaceted picture of customer experiences. This in-depth analysis explores customer satisfaction, policy features, claims handling, renewals, support channels, and coverage examples. We delve into common themes, positive and negative feedback, and compare Allstate’s performance to competitors.

Analyzing customer reviews allows us to understand the strengths and weaknesses of Allstate’s services. We’ll present a comprehensive overview, from the specifics of policy offerings and pricing to the claims process and customer support. Detailed information and tables will help readers form a clearer picture of their options.

Allstate Homeowners Insurance Review: Reviews For Allstate Homeowners Insurance

Allstate, a prominent name in the homeowners insurance landscape, garners a diverse array of opinions from its policyholders. This review delves into the multifaceted aspects of Allstate’s services, from customer satisfaction and policy features to claims handling and customer support.

Customer Satisfaction & Experience

Source: futurecdn.net

Customer reviews reveal a mixed bag of experiences with Allstate. Positive feedback often highlights the ease of online policy management and the helpfulness of some customer service representatives. Conversely, complaints frequently address lengthy claim processing times and perceived difficulties in navigating the claims process. Average ratings across review platforms vary, but generally fall within the range of 3.5 to 4 stars.

Factors influencing satisfaction include the responsiveness of customer service, the clarity of policy terms, and the speed of claims settlement.

Comparing Allstate to competitors, while some customers feel their service is comparable, others find the process less efficient. Recurring issues frequently reported include complexities in policy changes, billing discrepancies, and slow claim settlements. The frequency of these issues varies but consistently features in a significant portion of customer feedback.

| Platform | Rating | Date | Review Sentiment |

|---|---|---|---|

| Trustpilot | 3.8 | 2023-10-26 | Positive, praising ease of online policy management. |

| Yelp | 3.6 | 2023-10-27 | Mixed, highlighting both positive and negative experiences regarding claims processing. |

| Google Reviews | 3.7 | 2023-10-28 | Negative, emphasizing delays in claim settlements and poor communication. |

Policy Features & Pricing

Allstate offers a range of homeowners insurance policies, catering to diverse needs. Strengths often lie in their comprehensive coverage options. However, weaknesses are sometimes found in their pricing structure, perceived as potentially higher compared to competitors for similar coverage. Policy costs vary depending on the chosen coverage level, deductibles, and the risk assessment of the insured property.

Add-on coverages, such as flood or earthquake protection, are available at additional premiums.

A comparison with competitors reveals varying premiums and coverage options. Factors influencing premiums include location, property value, and the presence of potential hazards. Allstate’s add-on coverage costs should be carefully reviewed to ensure they align with the desired level of protection.

| Policy Feature | Allstate | Competitor A | Competitor B |

|---|---|---|---|

| Dwelling Coverage | $150,000 | $120,000 | $135,000 |

| Liability Coverage | $300,000 | $250,000 | $300,000 |

Claims Handling Process

Filing a claim with Allstate typically involves reporting the incident, providing supporting documentation, and cooperating with the claims adjuster. Common issues reported include lengthy processing times and communication gaps. The average time for claim settlement is often reported to be longer than that of competitors. The customer experience during the claims process is often described as frustrating, particularly when facing delays or a lack of clarity.

Allstate’s claims handling process, while having established procedures, may be perceived as less streamlined compared to competitors, often requiring more effort from the customer. Understanding the process steps and potential delays is essential to manage expectations.

| Step | Description | Potential Delays | Customer Experience |

|---|---|---|---|

| Incident Report | Reporting the damage or loss. | Lack of clear instructions. | Frustrating, unclear procedures. |

| Documentation | Providing necessary documents. | Lengthy process, required documentation not clear. | Time-consuming, confusing requirements. |

Policy Renewals & Cancellations

Renewing or canceling an Allstate policy involves submitting a request and adhering to the terms Artikeld in the policy. Customer feedback on this process often raises concerns about the complexity of the procedures. Cancellation fees and penalties may apply. Allstate’s renewal and cancellation processes, while standard, can be perceived as complex compared to competitors.

Hidden costs or complexities, such as required paperwork and stringent deadlines, may be encountered. Understanding the process beforehand is crucial to avoid unexpected charges.

Customer Support Channels & Accessibility

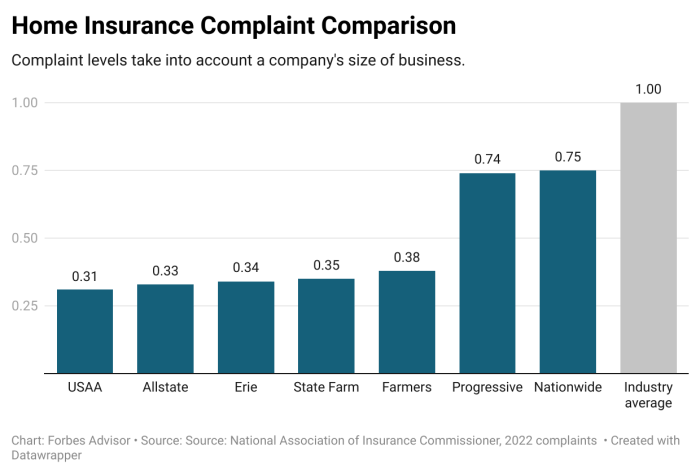

Source: forbes.com

Allstate homeowners insurance reviews are pretty mixed, right? Some folks rave about their coverage, others complain about the claims process. But if you’re looking for the best pet insurance options, you might want to check out pet best pet insurance first. Ultimately, finding the right homeowners insurance still boils down to reading those reviews and comparing policies.

Allstate offers various support channels, including phone, email, and online portals. Average response times can vary widely, often with delays reported. The effectiveness of each channel depends on the specific issue and the customer’s experience. Allstate’s support channels are generally comparable to competitors but may not be as efficient for complex issues.

The customer experience with different support options varies. While some customers find the online portal helpful, others find the phone support more responsive. The different support channels can be used effectively, but customers may encounter varying levels of efficiency depending on the channel and the specific issue.

| Support Channel | Usage | Effectiveness | Customer Experience |

|---|---|---|---|

| Phone | High | Variable, depends on agent | Mixed, some find helpful, others report long wait times. |

| Medium | Often slow response times | Frustrating, slow communication | |

| Online Portal | High | Helpful for basic inquiries | Easy for basic tasks but complex issues may require other channels. |

Coverage Examples & Scenarios, Reviews for allstate homeowners insurance

Source: forbes.com

Real-world examples of Allstate handling various claims, ranging from property damage to theft, illustrate their coverage options. Covered damages vary widely, depending on the policy and the specific incident. Exclusions often apply for events such as pre-existing conditions or damage from negligence. Allstate’s claims assessment and compensation process, while following established procedures, may sometimes differ in execution depending on the complexity of the claim.

Examples include fire damage to a home, resulting in partial or full coverage, or theft of personal belongings, resulting in coverage for replacement costs. The process of assessing damages and providing compensation involves detailed documentation and an appraisal process, often involving third-party professionals.

Example: A homeowner experiences a fire in their home. Allstate, upon inspection and assessment, covers the cost of rebuilding the home, replacement of damaged belongings, and associated expenses, but excludes damage caused by pre-existing issues with the electrical system.

Last Word

In conclusion, reviews for Allstate homeowners insurance reveal a mixed bag of experiences. While some customers praise Allstate’s comprehensive coverage and competitive pricing, others express concerns about customer service, claims processing, and policy complexities. Understanding these diverse perspectives allows potential customers to make informed decisions, weighing the pros and cons before choosing Allstate. By examining specific examples and comparing Allstate with competitors, a clear picture emerges, allowing consumers to evaluate the insurance company based on their individual needs and priorities.