Humana PPO insurance plans offer a diverse range of options for healthcare coverage. Understanding the specifics of these plans, from the various types and their associated costs to the intricacies of coverage and provider networks, is crucial for making informed decisions. This exclusive look delves into the details, providing a clear picture of what these plans entail, and helping you navigate the often-complex world of health insurance.

This in-depth analysis explores the different types of Humana PPO plans, highlighting their strengths and weaknesses. We’ll examine factors like premiums, deductibles, and co-pays, alongside the comprehensive coverage details for a wide array of healthcare services. A crucial aspect covered is how to navigate the provider network, find in-network providers, and understand the claim process. Ultimately, this guide equips you with the knowledge to choose the Humana PPO plan that best suits your needs.

Overview of Humana PPO Plans: Humana Ppo Insurance Plans

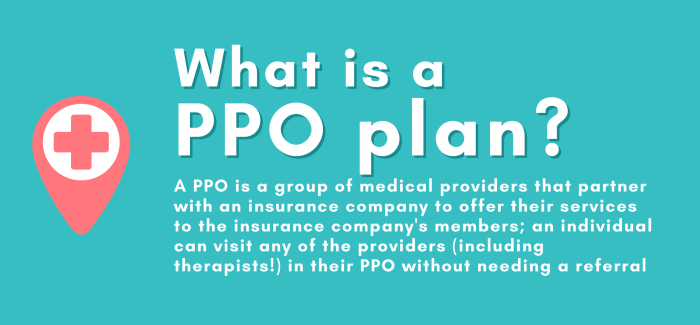

Humana PPO plans offer a flexible healthcare insurance option, allowing members greater freedom in choosing their healthcare providers. This overview details the key features, plan types, and cost structures of Humana PPO insurance plans.

Plan Types and Cost Structure

Humana offers various PPO plans, categorized by cost-sharing levels, which directly impact premiums, deductibles, and co-pays. These tiers, such as Bronze, Silver, Gold, and Platinum, reflect the balance between premium cost and coverage generosity.

| Plan Type | Premium (Estimated) | Deductible (Estimated) | Co-pay (Estimated) |

|---|---|---|---|

| Bronze | $150-$300/month | $1,500-$3,000 | $20-$50 per visit |

| Silver | $250-$400/month | $2,000-$4,000 | $30-$70 per visit |

| Gold | $350-$550/month | $3,000-$5,000 | $40-$80 per visit |

| Platinum | $450-$700/month | $4,000-$7,000 | $50-$100 per visit |

Note: Premiums, deductibles, and co-pays are estimates and may vary based on individual circumstances, location, and specific plan options. Consult Humana for precise details.

Coverage Details

Source: floridahealthcareinsurance.com

Humana PPO plans cover a wide range of healthcare services, encompassing preventive care, specialist visits, hospitalizations, and prescription drugs. Network coverage allows flexibility in choosing providers, but out-of-network care incurs higher costs.

Healthcare Services Covered

- Preventive care, including checkups and screenings

- Doctor visits and specialist consultations

- Hospitalizations and related services

- Prescription drugs (subject to formulary)

Network Coverage and Access

Humana PPO plans have a network of participating providers. In-network care generally has lower costs. Out-of-network care is available, but with higher out-of-pocket expenses.

| Service Category | In-Network Coverage (%) | Out-of-Network Coverage (%) |

|---|---|---|

| Primary Care Physician Visits | 90-95% | 50-70% |

| Specialist Visits | 80-90% | 40-60% |

| Hospitalizations | 95-100% | 70-85% |

Benefits and Disadvantages

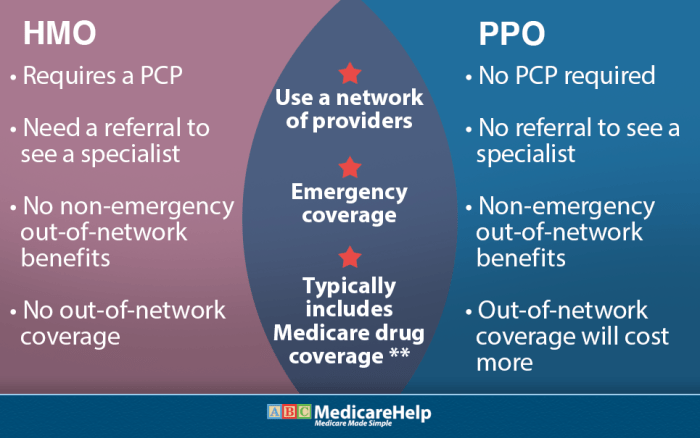

Humana PPO plans offer flexibility in choosing providers, but this comes with potential drawbacks. Comparison with other plans, such as HMOs, is crucial for informed decision-making.

Advantages

- Wider provider network than HMOs, giving more choice.

- Greater freedom to see out-of-network providers, though with higher costs.

- Flexibility in selecting specialists and hospitals.

Disadvantages

Source: abcmedicareandhealth.com

- Potentially higher premiums compared to HMOs.

- Higher out-of-pocket costs for out-of-network care.

- More complex to navigate than HMO plans.

Comparison with HMOs, Humana ppo insurance plans

Source: phonemantra.com

| Feature | Humana PPO | HMO |

|---|---|---|

| Provider Network | Wider | Narrower, usually requires PCP referral |

| Cost | Potentially higher premiums, but potentially lower out-of-pocket if in-network | Potentially lower premiums, but more limited provider choice |

| Flexibility | More flexibility in provider choice | Less flexibility, often requiring PCP referral |

Summary

In conclusion, Humana PPO insurance plans provide a spectrum of choices, each with its own set of benefits and drawbacks. This guide has illuminated the key features, cost structures, coverage details, and administrative processes. By understanding the various types of plans, their coverage specifics, and the factors to consider when choosing, you can make a well-informed decision about your health insurance needs.

Humana PPO insurance plans offer a range of coverage options, but navigating the complexities of medical expenses, particularly after a serious accident, can be challenging. Understanding your rights and potential recourse is crucial; seeking legal counsel from a qualified truck accident lawyer Montana, such as those specializing in truck accident lawyer montana , can significantly aid in the process of pursuing compensation for medical expenses and other damages.

Ultimately, Humana PPO plans should be considered alongside robust legal support when facing such unforeseen circumstances.

Navigating the complexities of Humana PPO plans empowers you to choose a plan that aligns with your healthcare requirements and budget.