Car insurance quote utah is crucial for every driver. Understanding the Utah insurance landscape empowers you to make informed decisions. This comprehensive guide explores the factors affecting your premiums, comparing providers, and outlining the requirements to secure the best possible coverage. It’s about more than just a price; it’s about safeguarding your financial future on the road.

From the different types of coverage available to the role of your driving record and vehicle type, this guide will equip you with the knowledge to navigate the complexities of Utah car insurance. Learn how to compare providers, understand the necessary requirements, and ultimately, secure a competitive quote. Unlocking savings and peace of mind is within your grasp.

Overview of Utah Car Insurance

Utah’s car insurance market is characterized by a blend of state regulations and private market competition. Understanding the available types of coverage, factors affecting premiums, and the role of the state’s regulatory body is crucial for making informed decisions.

Types of Car Insurance Available in Utah

Source: forbes.com

Utah drivers have access to various insurance coverages, including:

- Liability Insurance: This covers damages you cause to other people or their property in an accident.

- Collision Insurance: This covers damages to your vehicle in an accident, regardless of who is at fault.

- Comprehensive Insurance: This covers damages to your vehicle from events other than accidents, such as vandalism, theft, or weather-related damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

Factors Influencing Car Insurance Premiums in Utah

Several factors influence car insurance premiums in Utah:

- Driving Record: A clean driving record typically leads to lower premiums.

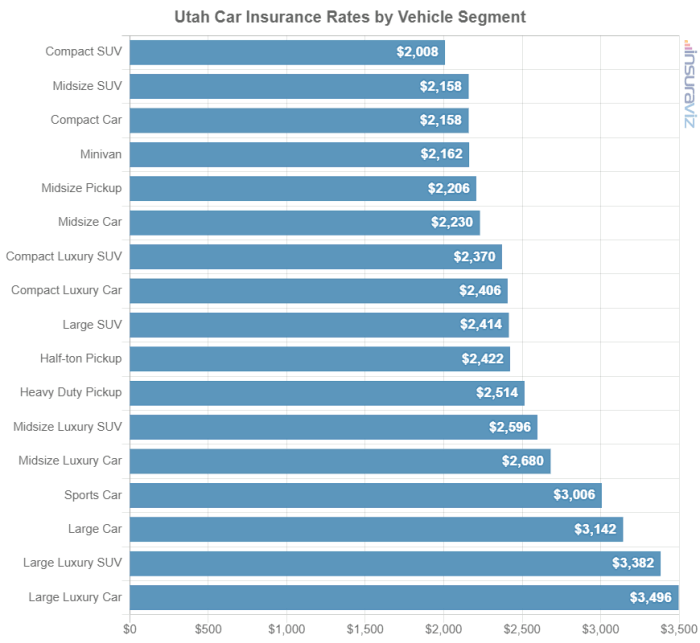

- Vehicle Type and Model: Certain vehicles are more prone to theft or damage, leading to higher premiums.

- Location: Areas with higher accident rates or higher crime rates tend to have higher premiums.

- Age and Gender: Younger drivers and male drivers often face higher premiums.

- Claims History: Past claims can significantly increase premiums.

Role of the Utah Department of Insurance

Source: insuraviz.com

The Utah Department of Insurance regulates the insurance industry in the state. Their role includes ensuring fair and competitive practices, and protecting consumers.

Common Car Insurance Coverage Options and Costs, Car insurance quote utah

| Coverage Type | Description | Typical Cost Range (Illustrative Example – Actual costs vary widely) |

|---|---|---|

| Liability | Covers damages to others | $50-$250 per year |

| Collision | Covers damage to your vehicle in an accident | $50-$200 per year |

| Comprehensive | Covers damage to your vehicle from non-accident events | $50-$150 per year |

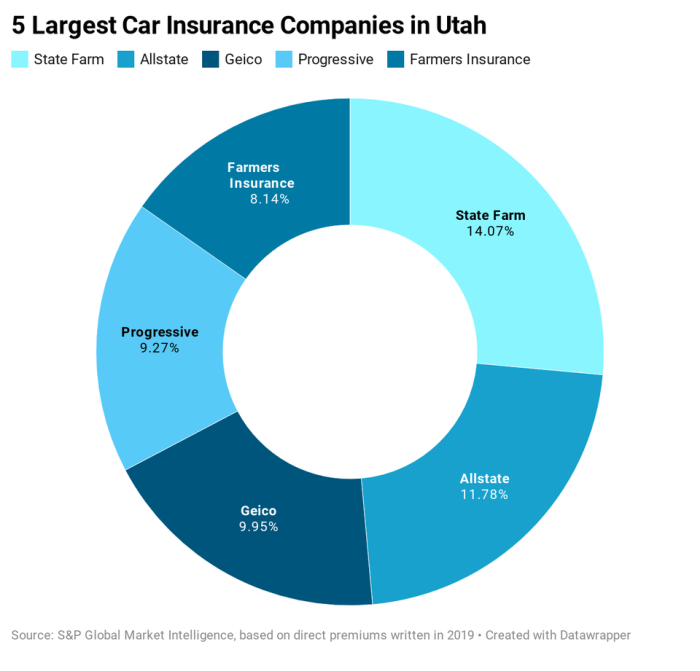

Comparing Utah Car Insurance Providers

Utah offers a range of insurance providers, each with its own pricing strategies and customer service approach. Comparing these providers can help you find the best fit for your needs.

Pricing Strategies and Strengths/Weaknesses

Providers employ various pricing strategies, often using factors like risk assessment and historical data. Customer reviews and industry reports can highlight strengths and weaknesses of different providers.

Discounts and Claims Process

Many providers offer discounts for good drivers, safe driving habits, or bundling policies. The claims process varies, so researching the procedures of each provider is vital.

Features and Costs of Top Providers

| Provider | Features | Typical Cost (Illustrative Example – Actual costs vary) |

|---|---|---|

| Provider A | Excellent customer service, good online tools | $150-$250 per year |

| Provider B | Wide range of discounts, strong claims process | $120-$200 per year |

| Provider C | Focus on digital interactions, competitive pricing | $100-$200 per year |

Understanding Utah Car Insurance Requirements

Utah has specific mandatory insurance requirements to ensure financial responsibility on the roads.

Need a car insurance quote in Utah? Finding the right policy can save you big bucks. But before you dive into comparing rates, consider something equally important: pet health insurance. Think about it – a good pets best pet health insurance plan can protect your furry friend from unexpected vet bills, freeing up cash for other important things, like your car insurance.

So, get your Utah car insurance quote today and don’t forget your four-legged family member!

Mandatory Insurance Requirements

Utah law mandates a minimum level of liability coverage. Failure to comply can lead to penalties.

Consequences of Non-Compliance

Driving without the required insurance can result in fines and other penalties, such as suspension of your driving license.

Financial Responsibility Laws

Utah’s financial responsibility laws Artikel the minimum requirements to ensure drivers are financially responsible for damages caused in an accident.

Required Coverages and Minimum Limits

| Coverage Type | Minimum Limit (Illustrative Example – Actual minimums may vary) |

|---|---|

| Bodily Injury Liability | $25,000 per person, $50,000 per accident |

| Property Damage Liability | $25,000 |

Factors Affecting Car Insurance Quotes

Various factors contribute to the cost of your car insurance in Utah. Understanding these factors can help you shop more effectively.

Driving History, Vehicle Type, and Location

Your driving history, the type and model of your vehicle, and your location all play a significant role in determining your insurance premiums.

Claims History, Age, and Gender

A history of claims, age, and gender are also key factors in the calculation of your premiums.

Comparison of Factors Affecting Quotes

| Factor | Typical Impact |

|---|---|

| Driving History | Clean records result in lower premiums |

| Vehicle Type | Certain vehicles have higher premiums due to risk factors |

| Location | Areas with higher accident rates have higher premiums |

| Claims History | Past claims significantly increase premiums |

| Age | Younger drivers often have higher premiums |

| Gender | In some cases, gender can influence premiums |

Tips for Getting a Competitive Car Insurance Quote

Several strategies can help you secure a competitive car insurance quote in Utah.

Comparing Quotes and Understanding Coverages

Comparing quotes from multiple providers is essential. Thoroughly understanding the different coverages offered is crucial.

Reading Fine Print and Bundling Policies

Carefully reviewing the fine print of insurance policies is important. Bundling insurance policies can often lead to lower overall costs.

Negotiating Rates and Step-by-Step Guide

Negotiating rates with providers is possible, though it requires a proactive approach. A step-by-step guide for obtaining a competitive quote will be helpful.

Resources for Utah Car Insurance Information

Several resources are available to help you find reliable information on Utah car insurance.

Reliable Websites and Contact Information

Source: ogdenutahinsurance.com

Numerous reliable websites and the Utah Department of Insurance offer valuable information. Contact information for the Utah Department of Insurance and consumer protection agencies is essential.

Reliable Resources for Car Insurance Information

| Resource | Description |

|---|---|

| Utah Department of Insurance | State regulatory body for insurance |

| Consumer Protection Agencies | Assist consumers with insurance issues |

| Comparison Websites | Compare quotes from multiple providers |

Illustrative Scenarios for Utah Car Insurance

Real-life scenarios illustrate the application of Utah car insurance policies.

Car Accident and Claims Process

A driver involved in a car accident would file a claim with their insurance provider, outlining the damages and injuries. The insurance company would then investigate and process the claim.

Policy Comparison and Discounts

Comparing policies from different providers can reveal substantial differences in premiums. Discounts can significantly impact the final cost of insurance.

Adjusting Coverage Based on Life Changes

Drivers may need to adjust their coverage as their life circumstances change. For instance, a newly married couple might need additional coverage.

Final Wrap-Up: Car Insurance Quote Utah

In conclusion, securing a competitive car insurance quote in Utah involves a strategic approach. By understanding the various factors influencing premiums, comparing providers, and grasping the requirements, you gain the power to make smart choices. This knowledge empowers you to protect yourself financially while enjoying the freedom of the road. Remember, the journey to finding the right car insurance quote begins with knowledge.

Empower yourself today!