Allstate auto insurance quote texas is your key to understanding the best auto insurance options in Texas. This guide dives deep into Allstate’s offerings, exploring everything from their market position to the claims process. We’ll compare Allstate with competitors, highlighting factors influencing quotes and providing clear steps for getting a personalized quote. We’ll even explore customer reviews to get a true picture of Allstate’s services.

Gaining a clear picture of Allstate’s auto insurance in Texas is crucial for any driver. This detailed look at Allstate’s offerings, from coverage options to pricing, will help you make informed decisions when choosing auto insurance in Texas. Understanding the factors that impact your quote is essential, and we’ll discuss those in detail. We’ll help you navigate the process of getting a quote and comparing it with other providers.

Overview of Allstate Auto Insurance in Texas

Allstate maintains a significant presence in the Texas auto insurance market, vying for a substantial market share alongside established competitors. Its diverse portfolio of policies caters to various needs and budgets, aiming to provide comprehensive coverage while offering competitive pricing.

Types of Auto Insurance Policies

Allstate offers a range of auto insurance policies tailored to Texas drivers. These policies encompass essential coverage options like liability, collision, comprehensive, and uninsured/underinsured motorist protection. Each policy type addresses specific risks associated with vehicle ownership and operation.

- Liability Coverage: Protects against financial responsibility for damages caused to others in accidents.

- Collision Coverage: Covers damage to your vehicle regardless of who is at fault.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events like fire, theft, or vandalism.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you are injured by a driver without adequate insurance.

Coverage Comparison with Competitors

Source: imagekit.io

| Coverage | Allstate | State Farm | Liberty Mutual | Geico |

|---|---|---|---|---|

| Liability | Standard coverage options | Standard coverage options | Standard coverage options | Standard coverage options |

| Collision | Flexible deductibles and limits | Flexible deductibles and limits | Flexible deductibles and limits | Flexible deductibles and limits |

| Comprehensive | Covers various perils | Covers various perils | Covers various perils | Covers various perils |

| Uninsured/Underinsured | Essential coverage | Essential coverage | Essential coverage | Essential coverage |

Note: Specific coverage details may vary based on individual policy terms and conditions. Always review policy documents for precise details.

Obtaining an Allstate auto insurance quote in Texas is a straightforward process. However, if you’re considering insurance coverage for a specific health condition, such as exploring if Olumiant is covered by insurance, you should consult your health insurance provider directly. For more information on Olumiant coverage, please see this helpful resource: is olumiant covered by insurance.

Ultimately, securing the right auto insurance coverage remains the primary focus.

Factors Influencing Auto Insurance Quotes in Texas

Source: mktgcdn.com

Several factors significantly influence the cost of auto insurance in Texas, affecting premiums for various demographic groups. These factors, including driving record, vehicle type, location, and age, play crucial roles in determining the premium amount.

Key Influencing Factors

- Driving Record: A clean driving record generally results in lower premiums, while accidents and violations lead to higher premiums.

- Vehicle Type: Higher-value vehicles or those prone to theft may result in higher premiums.

- Location: Areas with higher accident rates or greater risk factors often have higher insurance premiums.

- Age: Younger drivers typically face higher premiums due to a perceived higher risk profile.

Discounts Offered by Allstate

| Discount Type | Description |

|---|---|

| Safe Driving | Rewards drivers with accident-free records |

| Multi-Policy | Provides discounts for insuring multiple vehicles or policies with Allstate |

| Student Discount | Discounts available for students with good academic standing |

These discounts can help lower the cost of insurance premiums, allowing drivers to save money on their Allstate policies.

Obtaining an Allstate Auto Insurance Quote in Texas: Allstate Auto Insurance Quote Texas

Allstate offers various methods for obtaining an auto insurance quote in Texas, providing convenience and accessibility for potential customers. These methods include online, phone, and in-person options.

Methods for Obtaining a Quote

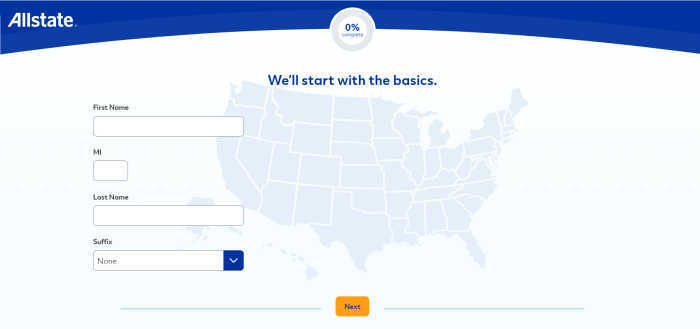

- Online: Accessing Allstate’s website allows for quick and easy online quotes. The process typically involves completing a form with personal information and vehicle details.

- By Phone: Contacting Allstate’s customer service representatives enables personalized guidance through the quoting process.

- In Person: Visiting an Allstate office in Texas allows for face-to-face interaction and assistance.

Steps for Completing an Online Quote

Source: texascarinsurance.com

The steps for completing an online quote usually involve providing details like driver’s age, driving history, vehicle information, and desired coverage levels. Accurate input is crucial for receiving a precise quote.

Comparing Allstate Quotes with Competitors

Comparing Allstate’s pricing with major competitors in Texas reveals potential differences in premiums for similar coverage options. These differences often stem from various factors, including underwriting procedures and market positioning.

Policy and Pricing Comparison, Allstate auto insurance quote texas

| Insurance Provider | Pricing | Coverage Options |

|---|---|---|

| Allstate | Competitive pricing | Comprehensive coverage options |

| Liberty Mutual | Competitive pricing | Comprehensive coverage options |

| State Farm | Competitive pricing | Comprehensive coverage options |

| Geico | Competitive pricing | Comprehensive coverage options |

Closing Notes

In conclusion, this guide provides a thorough overview of Allstate auto insurance in Texas. We’ve explored the nuances of their policies, pricing, and claims process. By understanding the various factors affecting your quote and comparing Allstate with other major players, you can confidently select the best insurance option for your needs. We’ve also included valuable resources for Texas drivers to help you in your research.

Hopefully, this comprehensive guide empowers you to confidently choose the perfect auto insurance policy for your situation.