Ally Ladder Life Insurance: Navigating the complexities of financial security just got easier. This comprehensive guide delves into the specifics, from coverage options and pricing to the application and claims process, ensuring you understand every aspect of this potentially life-changing product. Whether you’re looking for basic protection or a more elaborate plan, this analysis will help you make informed decisions.

This guide examines various aspects of Ally Ladder Life Insurance, including different policy options, premium structures, and the claim process. We’ll also compare Ally Ladder to competing products to give you a clearer picture of its value proposition. By the end, you’ll have a solid understanding of Ally Ladder Life Insurance and its potential benefits for your unique financial situation.

Ally Ladder Life Insurance offers a range of products, but understanding the broader insurance landscape is key. For instance, knowing who owns Biberk Insurance provides valuable context, especially when considering the competitive landscape. This knowledge, which can be found by visiting who owns Biberk insurance , helps illuminate the strategic moves and market dynamics within the life insurance industry.

Ultimately, it’s this kind of insight that helps consumers like you make informed decisions about Ally Ladder Life Insurance policies.

Understanding Ally Ladder Life Insurance

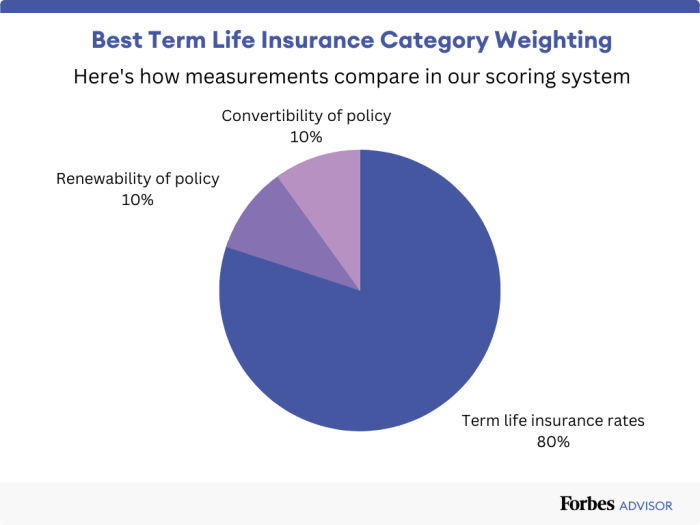

Source: forbes.com

Ally Ladder Life Insurance offers a tiered approach to life insurance, designed to be flexible and adaptable to various financial needs. It provides a range of coverage options, allowing individuals to choose policies tailored to their specific circumstances.

Key Features of Ally Ladder Life Insurance

- Tiered Coverage: The “ladder” aspect of the policy refers to increasing coverage amounts at different premium levels, making it adaptable as financial situations evolve.

- Affordability: Ally Ladder aims to provide competitive premiums for a range of coverage amounts, targeting individuals seeking accessible life insurance.

- Flexibility: The varying policy options allow for adjustments in coverage amounts and terms as needs change.

- Simplified Application: Ally Ladder’s online application process is designed to be user-friendly and straightforward.

Coverage Options

Ally Ladder offers different coverage options to meet diverse needs. These options include term life insurance, which provides coverage for a specific period, and permanent life insurance, which provides lifelong coverage. The options are designed for varying needs and circumstances.

Benefits and Drawbacks

Ally Ladder Life Insurance can be a good option for those seeking affordability and flexibility. However, it might not be the best choice for individuals needing substantial coverage or those seeking specific riders or add-ons. A comparative analysis with other insurers would be crucial to evaluate its suitability.

Eligibility Criteria, Ally ladder life insurance

Eligibility requirements for Ally Ladder Life Insurance are similar to those of other life insurance providers, including factors like age, health, and lifestyle.

Policy Terms and Conditions

Policy terms and conditions, including coverage duration, premium payment schedules, and claim procedures, are clearly Artikeld in the policy documents. Policies will vary based on the chosen coverage tier and individual circumstances.

Application Process

The application process typically involves completing an online form, providing required documentation, and undergoing a health assessment. This process is designed to be straightforward and efficient.

Comparison Table

| Feature | Ally Ladder | Competitor A | Competitor B |

|---|---|---|---|

| Premium Cost | (Variable, dependent on coverage and applicant) | (Variable, dependent on coverage and applicant) | (Variable, dependent on coverage and applicant) |

| Coverage Amount | (Tiered options) | (Various options) | (Various options) |

| Policy Term | (Term and permanent options available) | (Term and permanent options available) | (Term and permanent options available) |

Policy Options and Coverage

Ally Ladder Life Insurance provides a range of policy options, enabling customers to select the best fit for their needs. Each option comes with specific coverage amounts and levels.

Policy Options

Source: wealthysinglemommy.com

- Term Life Insurance: Provides coverage for a specified period, typically 10, 20, or 30 years.

- Permanent Life Insurance: Offers lifelong coverage with a cash value component.

Coverage Amounts and Levels

The coverage amounts are tiered, allowing for various options depending on the individual’s needs and financial situation. Specific amounts and details will be Artikeld in the policy documents.

Beneficiaries

The policy allows designation of beneficiaries, who will receive the death benefit upon the policyholder’s passing.

Riders and Add-ons

Certain riders and add-ons may be available, such as accidental death benefits or disability riders.

Policy Option Table

| Policy Option | Description | Premium |

|---|---|---|

| Term Life Insurance (10 years) | Coverage for 10 years | (Variable) |

| Term Life Insurance (20 years) | Coverage for 20 years | (Variable) |

| Permanent Life Insurance | Lifelong coverage with cash value | (Variable) |

Pricing and Premiums

Factors like age, health, and desired coverage amount influence the premium cost of Ally Ladder Life Insurance policies.

Premium Factors

- Age: Premiums typically increase with age.

- Health: Applicants with pre-existing conditions might face higher premiums.

- Coverage Amount: Higher coverage amounts lead to higher premiums.

Premium Comparison

A comparison of premium costs for similar coverage levels with competitor products would be helpful to make informed decisions.

Payment Options

Various premium payment options are available, including monthly, quarterly, semi-annual, and annual payments.

Premium Calculation

The premium calculation process is based on actuarial tables and risk assessments, ensuring fair pricing based on the risk profile of the applicant.

Premium Variation Table

| Age Group | Health Status | Coverage Amount | Premium |

|---|---|---|---|

| 25-34 | Excellent | $250,000 | (Variable) |

| 25-34 | Average | $250,000 | (Variable) |

| 25-34 | Good | $250,000 | (Variable) |

Final Conclusion: Ally Ladder Life Insurance

In conclusion, Ally Ladder Life Insurance offers a multifaceted approach to financial protection, catering to diverse needs and situations. Understanding the policy options, pricing, and application process empowers you to make well-informed decisions. This comprehensive overview highlights the potential advantages of Ally Ladder while acknowledging the need for careful consideration before committing to any life insurance policy. Ultimately, choosing the right policy depends on individual circumstances and priorities, making informed comparisons essential.