Amica life insurance quote is your key to understanding the specifics of life insurance policies from Amica. This comprehensive guide delves into the intricacies of securing the best possible coverage, from policy features and types to quotes, factors influencing premiums, and customer service options. This detailed analysis provides insights into Amica’s offerings, allowing you to make well-informed decisions.

The guide covers everything from understanding Amica’s diverse life insurance products to comparing them with competitors. It details the process of obtaining an online quote, highlighting crucial factors such as age, health, and lifestyle. You’ll also discover the options available for policy riders, add-ons, and payment methods, empowering you to select the best policy for your needs.

Understanding Amica Life Insurance

Amica Life Insurance offers a range of life insurance products designed to meet various needs and financial goals. This section provides a comprehensive overview of their key features, benefits, and available policy types, alongside comparisons with competitors.

Key Features and Benefits

Amica Life Insurance policies typically offer benefits such as financial protection for loved ones in the event of the policyholder’s death, and some plans include cash value accumulation options. Policies can provide a death benefit to beneficiaries, ensuring financial security for dependents. Many plans also offer flexibility with various riders and add-ons.

Types of Life Insurance Policies

Source: taxuni.com

Amica life insurance quotes provide a valuable starting point for evaluating comprehensive coverage options. Understanding the breadth of coverage offered is crucial, and this process naturally leads to considering alternative providers. For instance, determining if Allstate offers comparable homeowners insurance policies is pertinent to a comprehensive insurance strategy. Does Allstate do homeowners insurance ? Ultimately, a comparative analysis of various insurance providers, including Amica, is essential for informed decision-making.

Amica offers a variety of life insurance products, including term life insurance, whole life insurance, and universal life insurance. Each type has distinct characteristics and premiums based on factors such as the policyholder’s age, health, and lifestyle.

Comparison with Competitors

Amica Life Insurance is compared with other providers based on factors such as premiums, coverage amounts, and available add-ons. A comparative analysis is crucial in making informed decisions. Factors like the company’s financial strength and reputation are also considered.

Policy Coverage and Premiums

Coverage amounts and premiums vary based on the policyholder’s age. Younger individuals typically have lower premiums, while premiums increase with age due to the higher mortality risk. The table below provides a general overview.

| Age Group | Typical Coverage Amount | Approximate Premium (example) | Policy Type |

|---|---|---|---|

| 25-35 | $250,000 – $500,000 | $200 – $500/month | Term Life |

| 36-45 | $200,000 – $400,000 | $300 – $800/month | Term Life |

| 46-55 | $150,000 – $300,000 | $400 – $1,000+/month | Term Life |

Online Application Process

Amica’s online application process is straightforward and typically involves providing personal information, health details, and desired coverage amounts. The process is designed for ease of use.

Riders and Add-ons

Various riders and add-ons can enhance Amica life insurance policies, such as accidental death benefits, critical illness coverage, and disability riders. These add-ons can increase the overall value of the policy.

Amica Life Insurance Quotes

Obtaining a life insurance quote is a crucial step in evaluating the cost and coverage options. This section details the factors influencing quotes and the process of obtaining them from Amica.

Factors Influencing Quotes, Amica life insurance quote

Several factors influence the cost of life insurance, including age, health status, lifestyle, and the type of coverage desired. These factors play a significant role in the premiums.

Steps to Obtain a Quote Online

The online quote process typically involves providing personal information, answering health questions, and selecting desired coverage. The results show a personalized quote.

Importance of Accurate Information

Accurate information is critical for receiving an accurate quote. Inaccurate information can lead to an incorrect premium estimate and may affect eligibility.

Comparing Quotes with Competitors

Source: insuranceblogbychris.com

Comparing Amica’s quotes with other providers is essential to ensure the best value for the desired coverage.

Questions to Ask Before Selecting a Policy

Before choosing a policy, consider questions about coverage details, exclusions, and policy terms. It’s important to understand the policy fully.

Payment Options

Amica offers various payment options for premiums, including monthly, quarterly, or annual payments.

Factors Affecting Amica Life Insurance Quotes

Understanding the factors influencing life insurance premiums is crucial for making informed decisions. This section explores the impact of different factors on quote amounts.

Impact of Age

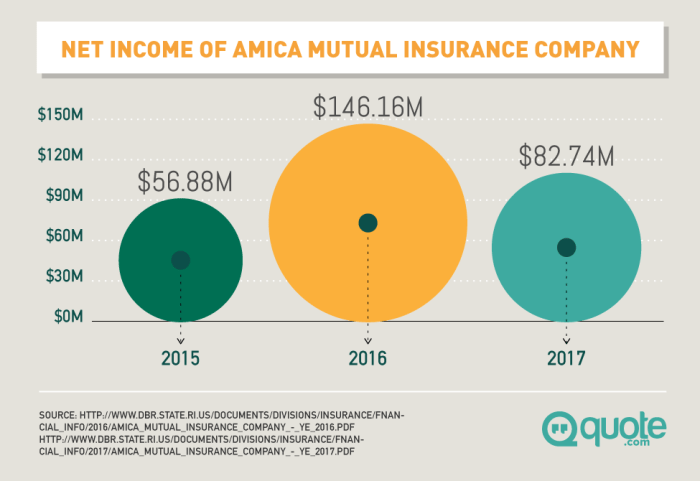

Source: quote.com

Age significantly impacts life insurance premiums, as the risk of death increases with age.

Health Status and Lifestyle

Health status and lifestyle choices are key factors in determining premiums. Healthy habits generally result in lower premiums.

Pre-existing Conditions

Pre-existing conditions may affect eligibility for certain life insurance policies. Some policies may have specific guidelines.

Amica Life Insurance Customer Service

Amica provides various customer service channels to address policyholder inquiries and concerns. Understanding these channels is important.

Contacting Customer Service

Amica provides multiple ways to contact customer service, including phone, email, and online chat.

Final Conclusion

In conclusion, navigating the world of Amica life insurance quotes can feel overwhelming. This guide provides a structured approach, enabling you to make an informed decision. By understanding the factors influencing premiums, comparing quotes, and grasping the customer service channels, you can confidently select a policy that aligns with your financial objectives. This comprehensive overview empowers you to choose the right life insurance coverage for your specific circumstances, ensuring your peace of mind and the security of your loved ones.