Amica Mutual Term Life Insurance: Imagine a world where your loved ones are protected, even if you’re not around. This isn’t just another insurance policy; it’s a promise, a safety net woven with careful consideration for your needs. It’s about knowing that even in the face of unforeseen circumstances, your family is covered. This comprehensive guide dives deep into the details, revealing the key features, costs, and benefits to help you make an informed decision.

We’ll explore everything from policy options and coverage amounts to the application process and customer support. Get ready to navigate the world of term life insurance with a fresh perspective, armed with the knowledge to choose the perfect plan for your specific situation.

Understanding Amica Mutual Term Life Insurance

Amica Mutual Term Life Insurance provides temporary life insurance coverage for a specific period. This coverage offers financial protection to loved ones in the event of the policyholder’s death during the policy term. It’s a popular choice for those seeking affordable life insurance without the long-term commitments of permanent policies.

So, like, amica mutual term life insurance is pretty legit, right? But, if you’re ever in a truck accident in Houston, TX, you definitely need a good lawyer, like the ones at truck accident lawyer houston tx. They can help you get the compensation you deserve, and then you can totally focus on getting your amica mutual term life insurance sorted out.

It’s important, you know?

Overview of Amica Mutual Term Life Insurance

Source: cribbinsurance.com

Amica Mutual Term Life Insurance is a type of temporary life insurance that covers a specified period. It offers a death benefit to beneficiaries if the insured person dies within the policy term. Key characteristics include flexibility, affordability, and a focus on providing coverage for a defined period.

-

Coverage Options: Amica Mutual typically offers various coverage options, including accidental death benefits, critical illness riders, and potentially other add-ons. The specific options may vary depending on the policy.

-

Policy Terms: Policies typically have terms ranging from 10 to 30 years. Policy terms are flexible and can be adjusted to meet individual needs. Policy terms are Artikeld in the policy documents.

-

Policy Conditions: Standard policy conditions apply, including the need for policyholders to meet certain health requirements and maintain the premiums. The policy’s fine print details the specifics.

| Feature | Amica Mutual | Other Term Life |

|---|---|---|

| Policy Costs | Generally competitive, often lower than permanent policies. | Premiums vary widely based on factors like age, health, and coverage amount. |

| Coverage Amounts | Ranges from $25,000 to $500,000+ (adjustable) | Wide range, typically adjustable to meet needs. |

| Policy Length | Flexible terms (10-30 years). | Flexible terms (10-30 years), potentially adjustable. |

Policy Benefits and Coverage

Amica Mutual Term Life Insurance offers a death benefit payable to beneficiaries in the event of the insured’s death during the policy term. Specific coverage amounts and types are detailed in the policy documents.

-

Benefits: The primary benefit is financial protection for loved ones. This protection can help with funeral expenses, outstanding debts, and ongoing living expenses.

-

Coverage Circumstances: Coverage is triggered by the death of the insured during the policy’s active term. Policies may have specific exclusions, as detailed in the policy documents.

-

Situations: This type of insurance is useful for providing a financial safety net for dependents in the event of unexpected death. It is a practical way to ensure financial security for family.

| Coverage Type | Description | Amount |

|---|---|---|

| Accidental Death | Provides an additional death benefit if death is caused by an accident. | Typically a multiple of the base death benefit. |

| Critical Illness | Pays a lump sum if the insured is diagnosed with a critical illness. | Varies depending on the policy and specific illness. |

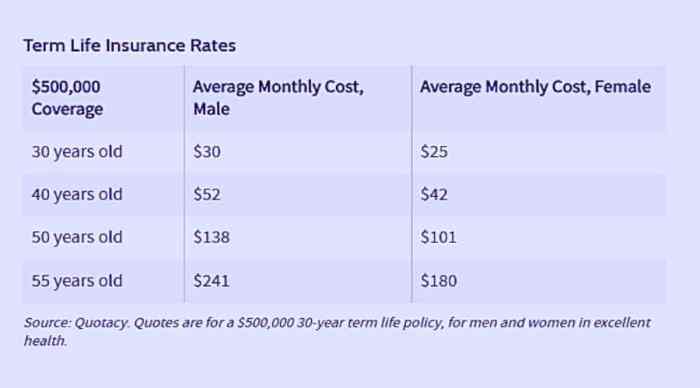

Policy Costs and Premiums

Premium costs are influenced by factors such as age, health, coverage amount, and policy term. The premium structure is Artikeld in the policy document.

-

Factors: Age, health, lifestyle choices, and the desired coverage amount all affect premium costs.

-

Affordability: Amica Mutual often aims for competitive premiums. Comparing different providers is advisable to understand the full picture.

| Policy Duration | Coverage Amount | Annual Premium |

|---|---|---|

| 10 years | $50,000 | Estimated $XXX (variable) |

| 20 years | $100,000 | Estimated $XXX (variable) |

Policy Application and Purchasing Process

Source: agentmethods.com

Applying for Amica Mutual Term Life Insurance typically involves providing personal information, health details, and financial data. A smooth application process is crucial.

-

Documents: The necessary documents and information are typically Artikeld in the application process. This may include proof of identity, medical history, and financial details.

-

Underwriting: Amica Mutual will assess the applicant’s health and financial information to determine eligibility and premium.

-

Timeline: The policy approval timeline can vary, depending on the complexity of the application and underwriting process.

Customer Service and Support

Amica Mutual provides customer service through various channels. The service experience is crucial for policyholders.

| Support Channel | Contact Information |

|---|---|

| Phone | (XXX) XXX-XXXX |

| [email protected] |

Amica Mutual Term Life Insurance vs. Competitors

Comparing Amica Mutual with other term life insurance providers is crucial to understanding the value proposition. Comparing different options ensures the best fit for the individual.

| Feature | Amica Mutual | Competitor A |

|---|---|---|

| Policy Costs | Often competitive. | May be higher or lower, depending on the specific policy. |

| Coverage Options | Various options available, including accidental death and critical illness. | Different options available, with potential variations in features and benefits. |

Illustrative Examples of Coverage, Amica mutual term life insurance

Illustrative examples of how Amica Mutual Term Life Insurance can provide coverage for various life events are helpful in understanding the policy’s practicality. Illustrative scenarios provide a clearer picture.

-

Scenario 1: A young professional secures a policy to protect their family in the event of unexpected death.

-

Scenario 2: A family buys a policy to provide financial security for their children’s education in case of the parent’s death.

Conclusive Thoughts: Amica Mutual Term Life Insurance

So, Amica Mutual Term Life Insurance – is it the right fit for you? We’ve dissected the policy, comparing it to competitors, highlighting its strengths, and outlining the potential benefits. Hopefully, this exploration has provided clarity and empowered you to make an informed choice about protecting what matters most. Take the time to weigh the pros and cons, consider your financial situation, and ultimately, choose the option that best aligns with your long-term goals.

Your peace of mind is worth it.