Is CIT FDIC insured? This crucial question demands a thorough investigation into the world of deposit insurance. Understanding the specifics of FDIC coverage is essential for safeguarding your hard-earned savings. This exploration delves into the complexities of FDIC insurance, examining coverage limits, insured institutions, and the claim process. We’ll also touch on the importance of protecting your deposits beyond the safety net provided by FDIC insurance.

CIT, like many financial institutions, is either FDIC insured or not. To know if your funds are safe, you need to know the institution’s status. We’ll explore the details behind the FDIC’s role in safeguarding your money. This will provide a clear picture of the insurance coverage you can expect if you choose to deposit your money at CIT.

Whether CIT is covered or not, this information is important for making informed financial decisions.

Understanding FDIC Insurance

FDIC insurance, a cornerstone of the US financial system, safeguards depositors’ funds in case of bank failures. This crucial safety net promotes stability and confidence in the banking sector.

Concise Explanation of FDIC Insurance

FDIC insurance is a government-backed program that protects depositors’ money in eligible financial institutions. It guarantees a certain amount of their deposits are returned even if the institution fails.

Purpose and Function of FDIC Insurance

The primary purpose of FDIC insurance is to maintain public confidence in the banking system. It reduces the risk of bank runs and financial panics by ensuring depositors’ funds are safe. FDIC insurance functions by acting as a guarantor of deposits, thereby mitigating the potential loss for depositors.

Benefits of FDIC Insurance to Depositors

FDIC insurance offers peace of mind to depositors. Knowing their funds are protected encourages savings and investment, which are vital for economic growth. It promotes financial stability by reducing the risk of depositors losing their money.

Comparison to Other Deposit Insurance Schemes

While FDIC insurance is the primary deposit insurance program in the US, other countries have similar schemes. Comparing coverage limits, eligibility criteria, and claim procedures between different programs can help understand the broader context of deposit protection measures globally. However, FDIC insurance is the focus here.

Table: Contrasting Deposit Insurance Programs

| Program | Coverage Limit (USD) | Eligibility Criteria | Claim Process |

|---|---|---|---|

| FDIC Insurance (USA) | 250,000 per depositor, per insured bank | Insured Banks | Detailed process described in section 4 |

| [Other Country’s Program] | [Coverage Limit] | [Eligibility Criteria] | [Claim Process] |

Coverage Limits and Exclusions

FDIC insurance offers a critical safety net, but understanding its limitations is essential. Knowing the maximum coverage per depositor and account type is crucial.

Maximum Coverage Per Depositor, Per Account Type

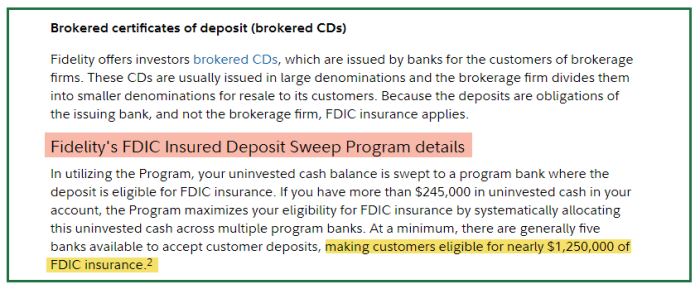

FDIC insurance typically covers up to $250,000 per depositor, per insured bank, across all accounts held at that bank. Specific account types might have varying implications, as detailed below.

Covered and Non-Covered Accounts

Checking accounts, savings accounts, and certificates of deposit (CDs) are typically covered. However, accounts held in trust or as part of a specific investment structure might have different coverage rules. Specific details are available on the FDIC website.

Factors Influencing Coverage Limits

Factors like the specific account type, ownership structure, and insured bank’s financial condition may influence the exact amount of coverage. It is recommended to consult with the FDIC or a financial advisor for precise details.

Implications of Exceeding Coverage Limits

Depositors holding more than the insured limit in a single insured institution face potential losses exceeding the coverage amount if the institution fails.

Determining if CIT is FDIC insured is crucial for understanding financial security. While CIT’s insurance status is important, navigating the complexities of a Pueblo auto accident, for instance, often requires legal expertise. A qualified Pueblo auto accident lawyer, like the one found at pueblo auto accident lawyer , can help resolve such cases. Ultimately, understanding the insurance backing of CIT is vital for making informed financial decisions.

Table: Account Types and FDIC Insurance Coverage

| Account Type | FDIC Coverage (USD) |

|---|---|

| Checking Account | 250,000 |

| Savings Account | 250,000 |

| Certificate of Deposit (CD) | 250,000 |

Insured Institutions and Eligibility: Is Cit Fdic Insured

Insured institutions adhere to strict FDIC regulations to ensure the safety of depositors’ funds.

Criteria for Institution Eligibility

Institutions meeting specific financial standards and regulatory requirements are eligible for FDIC insurance. These standards are designed to maintain the health and stability of the insured institutions.

Role of FDIC in Monitoring Institutions

The FDIC continuously monitors insured institutions to ensure compliance with regulations. This proactive approach helps maintain the safety net for depositors.

Examples of Insured and Non-Insured Institutions

Many national and state banks are FDIC-insured. Credit unions, while often insured by a different agency, might not fall under FDIC coverage. Check the FDIC website for the most up-to-date information.

Process of Becoming an FDIC-Insured Institution

Source: cs.bank

The process of becoming an FDIC-insured institution involves meeting certain capital requirements, adherence to regulatory standards, and undergoing FDIC evaluation. Detailed information is available on the FDIC website.

Claims and Procedures

In the event of an insured bank failure, the FDIC facilitates the claim process for depositors.

Process for Filing a Claim

Depositors must follow a specific process to file a claim. This usually involves providing necessary documentation and adhering to timelines.

FDIC Insurance in the News and Current Events

FDIC insurance plays a significant role in maintaining financial stability and public confidence.

Protecting Your Deposits

Taking proactive steps beyond FDIC insurance can further safeguard your deposits.

Questions to Ask Before Depositing, Is cit fdic insured

Thorough research and careful consideration of the institution’s financial health are essential before depositing funds. Asking pertinent questions can help you mitigate potential risks.

End of Discussion

Source: usefidelity.com

In conclusion, understanding FDIC insurance is paramount for safeguarding your financial well-being. We’ve examined the intricacies of coverage, insured institutions, and claim procedures. This analysis highlights the vital role of deposit insurance in maintaining financial stability and consumer confidence. While FDIC insurance provides a crucial safety net, remember that proactive financial strategies and careful institution selection are also key to protecting your deposits.

Ultimately, this knowledge empowers you to make smart financial decisions and effectively manage your funds.