Pets best health insurance is crucial for pet owners, offering vital financial protection when unexpected health issues arise. From common ailments to critical illnesses, insurance can help cover veterinary bills, making it easier to provide the best possible care for your furry friend. This comprehensive guide delves into the complexities of pet insurance, exploring different types of plans, providers, and the claim process.

Understanding your pet’s needs and the specifics of various policies is key to selecting the perfect plan.

This guide explores the essential factors in choosing the right insurance plan for your pet, including breed-specific considerations, various coverage options, and a step-by-step guide to navigating the claim process. We compare different providers and their plans, examining their strengths and weaknesses to help you make an informed decision.

Understanding Pet Health Insurance Needs: Pets Best Health Insurance

Providing comprehensive health coverage for our beloved pets is increasingly important, and pet health insurance plays a crucial role in ensuring their well-being. Understanding the factors that influence a pet’s need for insurance is paramount to making informed decisions. This involves considering their age, breed, lifestyle, and potential health predispositions.

Factors Influencing Pet Health Insurance Needs

- Age: Younger pets, especially puppies and kittens, are more susceptible to accidents and illnesses, requiring prompt and often costly veterinary care. Older pets may develop age-related conditions requiring ongoing monitoring and treatment.

- Breed: Certain breeds are predisposed to specific health issues. For example, large-breed dogs may be prone to hip dysplasia, while certain breeds of cats are susceptible to kidney disease. Understanding these breed-specific predispositions is crucial in assessing the need for insurance.

- Lifestyle: Active pets, such as those participating in rigorous sports or frequent outdoor activities, are at higher risk of accidents. Indoor pets, on the other hand, may be more prone to certain illnesses.

- Pre-existing Conditions: If a pet has a pre-existing condition, it’s essential to consider whether the insurance policy covers it. Many policies exclude pre-existing conditions, so it’s critical to review the policy details carefully.

Types of Pet Health Issues Covered

Pet health insurance policies typically cover a wide range of accidents and illnesses, including:

- Accidents: Trauma resulting from falls, collisions, or other mishaps.

- Illnesses: Conditions such as cancer, heart disease, and infections.

- Preventative Care: Some policies cover preventative care like vaccinations, wellness exams, and routine bloodwork.

Importance of Preventative Care

Investing in preventative care for pets is essential for maintaining their overall health and potentially lowering the risk of costly future treatments. Insurance can significantly support these efforts.

Typical Costs Associated with Common Pet Health Issues

The costs associated with common pet health issues can vary significantly. For example, emergency surgeries, dental procedures, and chronic illnesses can quickly deplete a pet owner’s savings. Insurance can provide a financial safety net in these situations.

Finding the best pet health insurance is crucial, right? But what if you just need coverage for accidents? Then checking out options like pets best accident only insurance might be your jam. Ultimately, the best pet insurance still depends on your furry friend’s needs and your budget, so weigh all the options carefully before signing up.

It’s all about finding the perfect fit for your pet’s health, ya know?

| Condition | Estimated Cost (USD) |

|---|---|

| Dental Cleaning | $300 – $1000 |

| Emergency Surgery | $1000 – $5000+ |

| Cancer Treatment | $5000+ |

Comparison of Pet Health Insurance Plans

| Plan Type | Coverage | Premium | Deductible |

|---|---|---|---|

| Example Plan 1 | Comprehensive coverage for accidents and illnesses, including preventative care | $50/month | $500 |

| Example Plan 2 | Limited coverage for accidents and illnesses, excluding pre-existing conditions | $25/month | $250 |

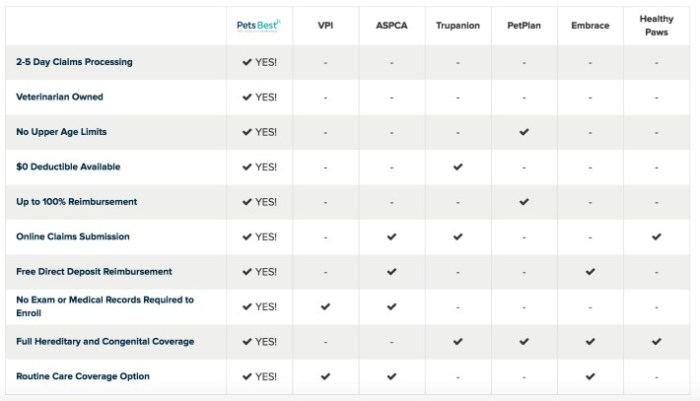

Comparing Different Insurance Providers

Choosing the right pet insurance provider is critical. Factors such as the provider’s reputation, financial stability, and the specific types of coverage offered should be carefully considered.

Benefits and Drawbacks of Different Providers

Source: ctfassets.net

Different providers offer varying levels of coverage and premiums. Some providers may have a strong reputation for customer service, while others may be known for their comprehensive coverage options.

Coverage Offered by Each Provider

Understanding the specific coverage options offered by each provider is essential for selecting the most appropriate plan.

Financial Aspects of Different Plans

The financial implications of various plans should be carefully evaluated, taking into account premiums, deductibles, and reimbursement rates.

Strengths and Weaknesses of Providers

| Provider | Strengths | Weaknesses |

|---|---|---|

| Example Provider 1 | Excellent customer service, wide range of coverage | Higher premiums compared to competitors |

| Example Provider 2 | Competitive premiums, quick claims processing | Limited coverage for certain pre-existing conditions |

Choosing the Right Plan

Selecting the ideal pet health insurance plan requires careful consideration of various factors, including the pet’s breed, age, lifestyle, and potential health risks.

Essential Factors for Pet Owners

Source: sugarthegoldenretriever.com

Essential factors to consider include the plan’s coverage, premium costs, and claim processing procedures.

Factors Affecting Plan Selection, Pets best health insurance

- Pet’s Breed: Breeds prone to specific conditions may require more comprehensive coverage.

- Pet’s Age: Younger pets require coverage for potential accidents and illnesses.

- Pet’s Lifestyle: Active pets require plans with higher accident coverage.

Evaluating Plan Features and Benefits

Source: ohmypets.net

Carefully assess the specific features and benefits of different plans to determine the best fit for your pet’s needs.

Comparing Different Plans

| Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Coverage for accidents | Comprehensive | Limited | Extensive |

| Lifetime coverage | Yes | No | Yes |

Final Review

In conclusion, choosing the right pet health insurance plan is a significant decision, one that requires careful consideration of your pet’s needs, lifestyle, and budget. This guide has provided a framework for understanding the complexities of pet insurance, from evaluating different plans to navigating the claims process. Remember, proactive planning and a thorough understanding of your options are key to ensuring your pet receives the best possible care, even in the face of unforeseen health challenges.