Plymouth Rock renters insurance: A surprisingly delightful way to safeguard your belongings and peace of mind, whether you’re a seasoned apartment dweller or a newbie navigating the rental landscape. This guide dives deep into the coverage, costs, and claim process, offering a lighthearted yet informative perspective on this essential policy. It’s like having a friendly, albeit slightly quirky, insurance companion ready to assist in any unfortunate incident.

This comprehensive overview of Plymouth Rock Renters Insurance covers everything from the basics of coverage to the nuances of policy comparisons, claim procedures, and valuable tips for choosing the right policy. We’ll explore the fascinating world of insurance, highlighting the unique aspects of this particular provider.

Plymouth Rock Renters Insurance: Protect Your Pad

Finding renters insurance that fits your budget and needs can feel like navigating a maze. Plymouth Rock Renters Insurance steps in to simplify the process, offering comprehensive coverage for your belongings and liability protection. This guide dives deep into everything you need to know about Plymouth Rock, from coverage details to the claim process.

Introduction to Plymouth Rock Renters Insurance

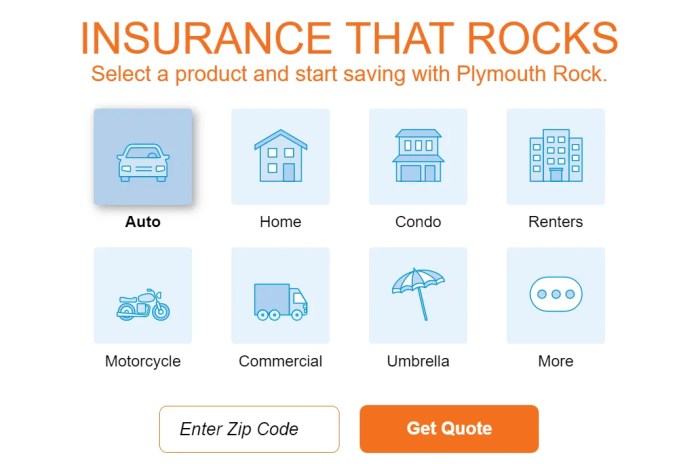

Source: agencyheight.com

Plymouth Rock Renters Insurance provides protection for your personal belongings and liability in case of accidents or damages. It’s a crucial safeguard for your peace of mind, ensuring your financial well-being in the event of unforeseen circumstances.

- Definition: Plymouth Rock Renters Insurance is a type of insurance policy designed to cover the personal property of tenants and provide liability protection in case of accidents or damages within the rental property.

- Typical Coverage: Policies typically cover personal property damage (fire, theft, water damage), liability for accidents that may harm others, and sometimes even medical expenses.

- Benefits: Having renters insurance gives you peace of mind, knowing your possessions are protected. It also safeguards you from potential lawsuits or financial burdens related to accidents. This is crucial for building a secure financial future.

- Common Exclusions: Common exclusions include pre-existing damage, wear and tear, certain types of water damage, and intentional damage. Always review the specific policy for detailed exclusions.

Comparing Plymouth Rock Renters Insurance with Competitors

Choosing the right renters insurance can be tricky, especially with so many options. This section compares Plymouth Rock to key competitors.

Plymouth Rock renters insurance is a solid option, but are you comparing apples to apples? If you’re considering alternatives like Lemonade home insurance, you should check out if it’s a genuine choice for your needs. Is Lemonade home insurance legit? Ultimately, Plymouth Rock still provides a good starting point for renters, especially if you’re looking for a more traditional approach.

- Comparison Criteria: Factors like coverage options, premiums, and customer service differentiate insurers. Plymouth Rock might excel in one area while another company offers better rates.

- Strengths and Weaknesses: Plymouth Rock’s strength might lie in its competitive premiums, while a competitor could have broader coverage options.

| Feature | Plymouth Rock | Competitor A | Competitor B |

|---|---|---|---|

| Coverage Options | Standard personal property, liability, and possible additional add-ons. | Comprehensive personal property and liability, including pet coverage. | Focus on high-value items and specialized coverage for specific needs. |

| Premiums | Competitive, varies based on location and coverage. | Slightly higher premiums but broader coverage. | Higher premiums for specialized coverage. |

| Customer Service | Generally good, with multiple contact methods. | High ratings for quick claim processing. | Known for personalized support. |

Coverage Details for Plymouth Rock Renters Insurance

Source: plymouthrock.com

Understanding the specifics of Plymouth Rock’s coverage is key. Here’s a breakdown of what’s included and excluded.

| Coverage Type | What’s Covered | What’s NOT Covered |

|---|---|---|

| Personal Property | Most personal belongings, including furniture, electronics, clothing. | Pre-existing damage, intentional damage, wear and tear, certain types of water damage. |

| Liability | Coverage for injuries or property damage you cause to others. | Injuries or damage caused by intentional acts, pre-existing conditions. |

Understanding the Cost of Plymouth Rock Renters Insurance

Source: plymouthrock.com

Several factors influence your premium. Understanding these factors helps you budget effectively.

- Factors Influencing Cost: Location, coverage amount, personal details like credit history, and claims history.

- Deductibles and Limits: Higher deductibles often mean lower premiums, but you’ll pay more out of pocket in case of a claim. Policy limits define the maximum amount the insurer will pay.

- Calculating Cost: Estimating costs requires knowing your location, desired coverage amounts, and personal circumstances.

| Factor | Impact on Cost | Example |

|---|---|---|

| Location | Higher in high-risk areas. | High-crime area vs. low-crime area. |

| Coverage Amount | Higher coverage means higher premium. | Protecting $100,000 worth of belongings vs. $50,000. |

| Credit History | Poor credit can lead to higher premiums. | Impact on rates based on creditworthiness. |

Conclusive Thoughts: Plymouth Rock Renters Insurance

In conclusion, navigating the world of renters insurance, particularly with Plymouth Rock, can feel like a treasure hunt. This guide has unearthed the key aspects, allowing you to confidently choose a policy that perfectly suits your needs and budget. Remember, understanding your coverage is paramount, and this guide is your friendly map to securing your rental haven. So, go forth, armed with knowledge, and secure your future with Plymouth Rock renters insurance.

Happy renting!