Prior insurance requirements not met Allstate can lead to unforeseen complications, potentially jeopardizing your coverage. Understanding these requirements is crucial for securing the protection you need. This exploration delves into the complexities of prior insurance requirements, examining potential consequences, common reasons for non-compliance, and the critical steps to take to avoid such issues.

Navigating the world of insurance can feel like navigating a maze, but understanding the rules of the game can lead you to a clearer path. This guide provides a comprehensive understanding of Allstate’s prior insurance requirements, empowering you to make informed decisions and ensure your policy is secure and effective.

Understanding Prior Insurance Requirements at Allstate

Meeting prior insurance requirements is crucial for maintaining valid Allstate coverage. Failure to meet these requirements can lead to significant repercussions, ranging from policy voidance to reduced coverage. This section delves into the intricacies of these requirements, highlighting potential consequences, common reasons for non-compliance, and the verification process.

Detailed Explanation of “Prior Insurance Requirements Not Met”

Allstate’s prior insurance requirements necessitate verification of the policyholder’s insurance history with other providers. This involves confirming the dates of coverage, policy numbers, and the insured vehicles. Non-compliance occurs when the policyholder fails to provide accurate and complete information about their prior insurance history, leading to potential policy issues.

Potential Consequences for Allstate Customers

Failing to meet prior insurance requirements can have severe consequences for Allstate customers. These consequences can range from policy voidance, rendering the policy ineffective, to reduced coverage amounts for claims. In some cases, the policy may be reinstated upon providing the necessary documentation, but it’s essential to understand the implications beforehand.

Common Reasons for Non-Compliance

Customers may not meet prior insurance requirements due to various reasons. These include lost records, inaccurate information provided during the application process, or failure to retain essential documentation. Mistakes in data entry or misremembering dates can also lead to non-compliance.

Comparison of Prior Insurance Requirements

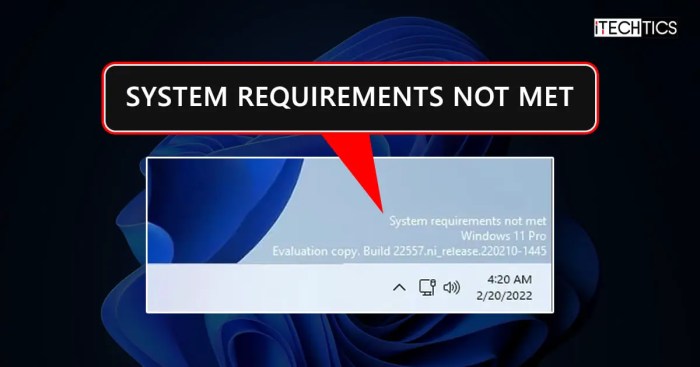

Source: itechtics.com

Allstate’s prior insurance requirements might differ based on the specific policy type and individual circumstances. Some policies may demand a more rigorous verification process than others. The nature of the prior insurance requirement, such as the period of coverage or the specific vehicle insured, can influence the requirements.

Verification Process for Prior Insurance Information

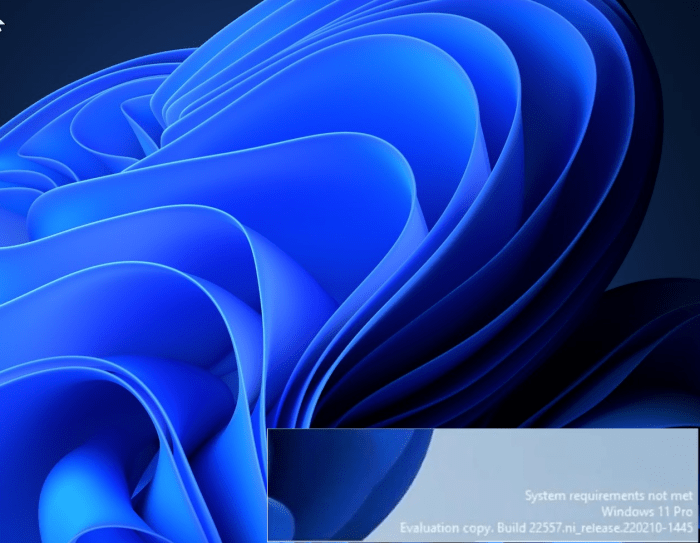

Source: gearupwindows.com

Allstate utilizes various methods to verify prior insurance information. This can include contacting previous insurance providers, reviewing online records, or employing third-party verification services. The exact verification method used depends on the specific situation and policy type.

Types of Coverage Affected

Allstate policies, particularly those involving liability, collision, and supplemental coverage, can be impacted by unmet prior insurance requirements. The extent of the impact depends on the nature of the requirement and the specific details of the non-compliance.

Impact on Different Coverage Types

| Coverage Type | Impact of Unmet Requirements | Example Scenario | Further Details |

|---|---|---|---|

| Liability | Policy may be void or have reduced coverage. | Driver with no prior insurance causes an accident. | The policy may be deemed void, or the liability coverage may be reduced to a minimum threshold. |

| Collision | Policy may not apply. | Car is damaged in an accident. | The collision claim might be denied or the coverage significantly reduced due to the lack of prior insurance. |

| Supplemental Coverage | Coverage might be limited or unavailable. | Roadside assistance or rental car coverage is needed. | Supplemental coverage options might be restricted or unavailable if prior insurance requirements aren’t met. |

Customer Interaction and Resolution

Allstate addresses customer inquiries regarding unmet prior insurance requirements through a structured approach. This involves clarifying the nature of the requirement, providing options for resolution, and outlining potential appeals processes.

Common Customer Inquiries and Potential Answers

| Customer Question | Potential Answer | Further Details |

|---|---|---|

| What happens if I didn’t meet prior insurance requirements? | Your policy may be void or have reduced coverage. | The specific impact depends on the nature of the unmet requirement and the type of coverage. |

Prevention and Mitigation

Proactive measures can help customers ensure they meet Allstate’s prior insurance requirements. This involves maintaining accurate records, promptly updating information, and understanding the specific requirements for each policy.

Proactive Steps to Avoid Issues

- Maintain detailed records of all insurance policies, including dates of coverage and policy numbers.

- Provide accurate and complete information during the application process.

- Understand the specific requirements of each policy type.

- Keep a copy of the insurance policy information, and make sure to review all documentation carefully.

Illustrative Scenarios

These scenarios demonstrate the potential impact of unmet prior insurance requirements and the resolution process.

Failure to satisfy prior insurance requirements with Allstate can significantly complicate personal injury claims. Navigating these complexities often necessitates the expertise of a qualified personal injury lawyer, such as those found in Palm Harbor. Personal injury lawyer Palm Harbor specialists can assess the specifics of unmet requirements and advise on potential legal strategies to mitigate the negative impacts on the claimant’s case, ultimately maximizing the chances of a favorable resolution regarding prior insurance requirements not met with Allstate.

Scenario 1: Unmet Requirements, Prior insurance requirements not met allstate

A customer applied for a new Allstate policy, but failed to correctly report their previous insurance history. As a result, their policy was deemed void. Upon providing the necessary documentation, the policy was reinstated. This scenario highlights the importance of accurate reporting and the potential for resolution.

Scenario 2: Successful Compliance

A customer accurately reported their prior insurance history. The Allstate policy was processed successfully, and the customer experienced no issues. This illustrates the benefits of adhering to Allstate’s prior insurance requirements.

Ultimate Conclusion: Prior Insurance Requirements Not Met Allstate

In conclusion, meeting prior insurance requirements with Allstate is paramount to securing comprehensive coverage. This guide has illuminated the intricacies of these requirements, outlining potential consequences, resolution processes, and preventive measures. By understanding these crucial elements, you can safeguard your interests and ensure a smooth and protected insurance experience.